Insights

Stay up-to-date with our latest news and insights.

Vendors - Meet Your Sales Growth Potential by offering Operating Lease Finance

19 Apr 2024

From the sticker shock of pricing to the reluctance to commit to a particular technology, these obstacles can derail strong buying intentions and hinder your business growth. Maia Financial's flexible Operating Leases address the pain points of new equipment acquisition head on.

Read MoreLatest Insights…

Flexible High-volume facility to Unlock Innovation

22 Mar 2024

From artificial intelligence to robotics and the Internet of Things (IoT), the possibilities are limitless. However, those executives charged with accessing the latest technology presents are only too aware of the challenges around capital risk, technology integration and having the capability to identify the best equipment when you know a rapid stream of upgrades is just around the corner. Add to this any challenges around budget constraints or uncertain market conditions and risk management becomes even more complex.

Read MorePractical Support for Healthcare Providers under Pressure

5 Feb 2024

If the healthcare sector is going to be successful in meeting the challenges of the future financial landscape, a review of new options that favour flexibility, customisation and capital preservation is indicated.

Read MoreAusbiz - Equipment Finance Outlook 2024

31 Jan 2024

Maia Financial's Managing Director, Robert Indovino appearance on AusBiz to deliver a 2024 Asset Finance Outlook.

Read MoreUnlock Growth with Assets as a Service

22 Jan 2024

Recently we have witnessed a significant shift among our clients towards embracing operating leases that embody the essence of "Assets as a Service" (AaaS). This adjustment in thinking considers how equipment finance can be integrated into a comprehensive lifecycle management system.

Read MoreRefuel your Capital

12 Jan 2024

Maia Financial offers the 'Sale and Rent Back' (SARB) facility. This enables you to be reimbursed for eligible equipment opting to spread out large expenditure across incremental payments to maintain budget stability.

Read MoreVeterinary Excellence: A pathway to the latest technology for practices.

15 Nov 2023

In the dynamic landscape of veterinary care, where cutting-edge technologies are transforming the way animals are treated, Maia Financial is enabling practices of all sizes to integrate these innovations.

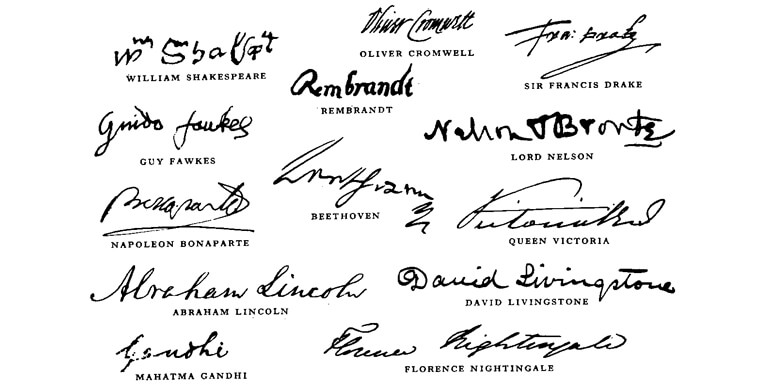

Read MoreSigned, sealed, delivered - Improve your transactions flow with Maia Financial

2 Nov 2023

One of the fundamentals of capturing market momentum and deal-making is being tech savvy, especially when it comes to secure data and document signing.

Read MoreThe bridge between innovation and healthcare delivery

19 Oct 2023

Our goal is to be the bridge between innovation and healthcare delivery, ensuring facilities have access to cutting-edge equipment to deliver the best care possible.

Read MorePump up the Volume - Unlocking the Profits of AV Technology

5 Sep 2023

A key learning from the pandemic is that audio visual technology is the key connector to brand experience and a core driver of business growth.

Read MoreFast-tracking Technology and Supporting Teaching Challenges

5 Jul 2023

Implementing new technologies in schools can be costly and complex, diverting attention from the core objective of embracing these learning opportunities. Maia Financial offers a solution by fast-tracking technology integration and providing flexible finance options to educators.

Read MoreInsider Insights

Keep up to date with our team’s favourite reads.